Originally posted at WealthManagement.com on May 9, 2025

With the stock market at all-time highs and volatility normal, it’s easy for retirees and near-retirees to get complacent about sequence risk, one of the biggest dangers to a retirement nest egg and investor’s peace of mind. No one knows exactly when the next big market correction will occur, but when it does, as we saw in 2000-2003 and 2008-2010, the sequence of returns risk (a sudden drop in the market extending over an extended period) can wreak havoc on retirement projections and planning.

At times like these, retirees, particularly those in early retirement and near retirement, are particularly vulnerable to sequence-of-returns risk. Sequence risk refers to the devastating impact poor investment returns will have on a retiree’s investment account if the market drops precipitously in the early retirement years. Sequence risk can cause a retiree’s income to drop significantly over their lifetime or induce an inescapable downward spiral where they could even run out of capital.

Taking distributions when the market has precipitously declined effectively “costs” the retirement plan more than it can sustain and often prevents recovery. This decline results in the need for major economic adjustments to forthcoming distributions and lifestyle—something everyone wants to avoid as they age.

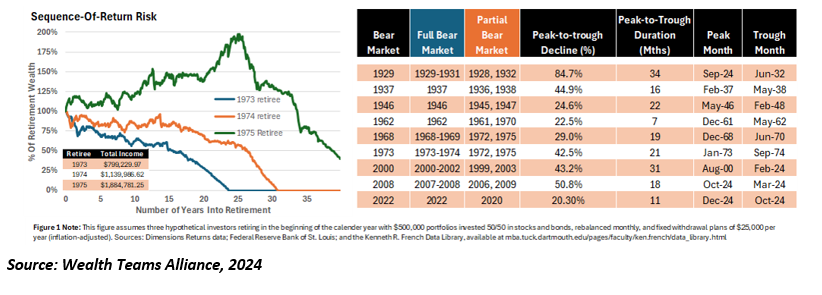

The graphic below shows the impact of sequence risk on three investors who started taking distributions in 1973, 1974, and 1975, respectively. The assumptions were based on each investor withdrawing $25,000 a year of income, plus inflation.

The outcomes are quite different depending on when each investor started taking distributions—Investor 1 (starts in 1973), Investor 2 (starts in 1974), and Investor 3 (starts in 1975). Assuming each investor began with $500,000 in a balanced portfolio, evenly split between stocks and bonds, and rebalanced monthly, they achieved significantly different long-term results. We assumed the portfolios were the retirees’ sole source of income for 35 years of retirement. All also assume all three withdrew $25,000 per year (5%), adjusted for inflation—higher than the popular 4% rule of thumb but more aligned with what retirees want to receive in annual income.

Without considering withdrawals,

- The 1973 retiree had a long-term return of 7.12%.

- The 1974 retiree had a long-term return of 8.81%.

- The 1975 retiree had a long-term return of 14.12%.

Further, after factoring in withdrawals, they experienced widely divergent outcomes. The 1973 retiree, who left work in a severe bear market decline, would have run out of money after just 24 years in retirement. By postponing retirement just one year, however, the 1974 retiree— who left work at the tail end of the 1973-74 bear market—would have run out of money after 31 years. The 1975 retiree who left work at the beginning of a bull market saw substantial growth in their retirement account. She was able to leave a bequest of about $135,000 after 40 years of retirement.

Again, here are some of the biggest dangers of sequence risk:

- Impact on portfolio longevity. If a retiree experiences negative returns early in retirement and withdraws funds from their portfolio during those years, they can deplete their nest egg much faster than expected, potentially leading to a premature failure in their portfolio. Once a downward spiral begins, it’s difficult to escape it.

- Sequence matters. The order in which investment returns occur significantly impacts a portfolio’s overall growth and longevity. Experiencing negative returns early in retirement can be more detrimental to a retiree’s long-term distributions than experiencing the same negative returns later in retirement, i.e., after the portfolio has had more time to grow.

- Withdrawal rate considerations: Sequence risk is closely tied to a retiree’s withdrawal rate. Higher withdrawal rates increase the impact of sequence risk. Potential negative returns could deplete the account faster when a larger percentage of the portfolio is withdrawn.

Four ways to minimize sequence risk

1. Maintain Spending Flexibility. Here, we maintain a balanced investment portfolio while allowing for flexible spending. We mitigate sequence risk by reducing spending after a portfolio decline, allowing more money to remain in the portfolio so it can take part in any subsequent market recovery. However, the retiree has less spendable income during this period.

Withdrawing a constant percentage of remaining assets minimizes the sequence of returns risk. It is important not to put too much pressure on the portfolio during the early retirement years. While a constant withdrawal percentage can reduce the pressure, if the portfolio drops 20% to 30% in one year, as the market has in the past, withdrawing an income only increases the amount the portfolio has to recover. This dangerous strategy can cause a depletion of assets in the future.

2. Reduce Volatility (When It Matters Most). Individuals should not expect constant spending from a market-based portfolio since the likelihood of volatility is too high. Those who want an upside and are willing to accept volatility should be flexible with their spending and consider abstaining from withdrawals until the storm passes. Retirees can reduce volatility by building a portfolio based on distributions instead of growth. They can set aside expected distributions into a bucket and then invest the remaining portfolio without withdrawing funds.

Spending should be kept constant if the portfolio is “de-risked.” To get constant spending, investors could look to hold fixed-income assets to maturity or use risk-pooling assets like income annuities or other fixed assets. Other approaches to reducing downside risk (volatility in the undesired direction) could include using a rising equity glide path in retirement. The path starts with an equity allocation that is even lower than typically recommended at the start of retirement but then slowly increases the stock allocation over time. Doing so can reduce the probability and magnitude of retirement failures. This approach reduces vulnerability to early retirement stock market declines that cause the most harm to retirees.

Asset allocation could also be managed with a funded ratio approach, in which more aggressive asset allocations are used only when sufficient assets are available beyond what is necessary to meet retirement spending goals. Finally, financial derivatives or income guarantee riders can be used to place a floor on how low a portfolio may fall by sacrificing some potential upside.

3. Buffer Assets – Avoid Selling at Losses. Here, the retiree uses other assets available outside of the financial portfolio from which to draw after a market downturn. Returns on these assets should not be correlated with the financial portfolio since the purpose of these buffer assets is to support spending when the portfolio is otherwise down. An old strategy in this category is to maintain a separate cash reserve — say two or three years of retirement expenses — separate from the rest of the investment portfolio.

While buffering assets is a safe approach, one disadvantage is that the cash reserve could have otherwise been invested to seek higher returns than cash provides. Cash can be a drag on the portfolio, and in recent years, more attention has been focused on using other alternatives.

4. Bucket Strategy: This involves segmenting a retirement portfolio into different “buckets” or asset pools, each serving a different purpose (e.g., short-term cash needs, medium-term investments, long-term growth).

The idea behind this strategy is to access cash in the short term so a retiree does not have to worry about stock market fluctuations. Theoretically, they shouldn’t have to sell their investments during a down market to fund their annual withdrawals.

Here are some suggested allocations for each of the three buckets:

a. The Immediate Bucket contains short-duration CDs, T-bills, high-yield savings accounts, and other similar assets. Ideally, clients hold enough cash in the immediate bucket to fund up to two years of living expenses.

b. The Intermediate (Middle) Bucket covers expenses from Year 3 through Year 10 of retirement. Money in the intermediate bucket should continue to grow to keep pace with inflation. However, investors will want to avoid investing in high-risk assets. Possible financial instruments include longer-maturity bonds and CDs, preferred stocks, convertible bonds, growth and income funds, utility stocks, REITs, and more.

c. The Long-Term Bucket contains investments that align with historical stock market returns. These assets grow a retiree’s nest egg better than inflation and allow them to refill their immediate and intermediate buckets. Here, we place a diversified portfolio of stocks and related assets. It should be allocated across domestic and international investments, ranging from small-cap to large-cap stocks.

Conclusion

Ultimately, a good retirement program protects capital, reduces financial (and psychological) risk, and provides a long-term investment framework that can weather any financial storm.

Dr. Guy Baker, CFP, CEPA, MBA is the founder of Wealth Teams Alliance (Irvine, CA). He has been listed in the Forbes 250 Top Financial Security Professionals List and authored Maximize the RedZone, a guide for business owners as well as The Great Wealth Erosion, Manage Markets, Not Stocks and Investment Alchemy. He also wrote “How to Choose a financial Advisor. Among his many awards and honors, he received the 2019 John Newton Russell Memorial Award for lifetime service achievement in the life insurance industry.